month end close process xero

Finalise the Trust bank reconciliation. Use the drop down arrow to choose the correct bank or credit card account and edit the date to reflect the month end you are reconciling.

8 Things Most People Forget With Their Xero Setup Bean Ninjas

You will see the statement balance at the bottom.

. Reconcile all bank accounts and inventory assets in your accounting system. Businesses care about filing their financial statements monthly because it helps maintain a healthy cash flow facilitate financial planning assist in making strategic business decisions and measure. Bank all payments youve received.

Your business wont survive unless you have a tight grip on your finances. Under Lock Dates delete the date in the Lock Date field then click Save. If Close Off not already run Run Close Off for last day of month.

Its impossible to accurately track performance if those numbers bounce around when someone finds invoices or bills that werent recorded on a timely basis or when someone changes transactions from previous months or even previous years. Invite your accountant or bookkeeper to be a user. Close off the Trust bank reconciliation.

Enter and approve all invoices bills and expense claims. Reconcile sales additional accounts. The idea is simple by.

Then select End of Year Reports and STP Finalisation. Expenses and bills. WEEKLY PROCESS OVERVIEW CHECKLIST.

To ensure your month-end close is as smooth and painless as possible it pays to follow a month-end close checklist. In this video I show you how I create a month-end close checklist which acts as a guide for the whole accounting team to close the month and produce financial statements. To achieve an efficient process ideally each business should have their Month End Workflow mapped out step-by-step highlighting the potential bottlenecks.

Make sure you carefully manage. Month end close is the process of collecting and filing all financial and accounting information for review reconciliation and reporting at the end of each month. Go to Accounting Bank accounts and for each bank account click on Manage Account Reconciliation Report.

The goal of the month-end close process is to give businesses a clear view into how your organization performed that month. A checklist will help you keep track of essential information and minimize time-consuming errors and redundancies. This entails taking into account every transaction that month adjusting and finalizing your balances and producing reports to share key metrics with your management team.

This will give you a list of all employees both current and former. If your client is a larger employer youll discover that STP offers some improvements on PSARs. Upload and publish or enter all invoices and receipts.

Users with the advisor user role can remove lock dates temporarily to allow changes to transactions. Process the year end. Heres a quick summary of the month end close process steps.

Close the period in your financial system. Fully reconcile all of your bank accounts and ensure they agree with the balances from your bank statements. Carefully review all statements.

During your month-end close process you need to reconcile all of your accounts. To do this match your records to your account statements from outside entries such as the bank. The month-end close process is a set of steps that closes your books at the end of the month to set your numbers in stone.

You are now ready to commence Month End Close off. Select the last day of the month you are checking and update the report. Select the Dashboard tab in your Blue Xero toolbar.

Make sure your records for the month are accurate by performing a bank statement reconciliation. Click Update to produce the report. First under Payroll choose Employees.

In the Accounting menu select Advanced. Tasks should be split into daily weekly and monthly and a review undertaken to identify what processes can be simplified using technology and automation. 8 Things Most People Forget With Their Xero Setup Bean Ninjas Best Accounting Practices For Stripe Xero Small Business Accounting Software Xero My How To Use Quickbooks And Xero For Your Month End Close Process How To Get Early Access To New Features And Inform The Future Of Xero Xero Blog Xero Accounting Software Review 2022 The Blueprint.

The month end process is best run in this order In Infinitylaw. Review bills to pay. Run Day Month close until last day of month.

This monthly checklist will help you assess the health of your business and stay in control. Typically you can break your accounts down into three categories. Enter all customer and vendor invoices into your accounting system.

Together with this month-end closes will help you complete your books and for now report accurate and timing turnover figures to the ATO and more importantly get some CASH. In Xero Accounts Payable Module. Make sure you do these things for the financial period being closed.

Step back and do a financial overview. Check the bank reconciliation reports for each bank account. What is the month-end close process.

Xero Tutorial Training Closing And Locking Accounting Periods In Xero Youtube

Xero Vs Quickbooks Which Is Best For Small Business In 2022

Hotel Accounting Made Easy With Preno And Xero

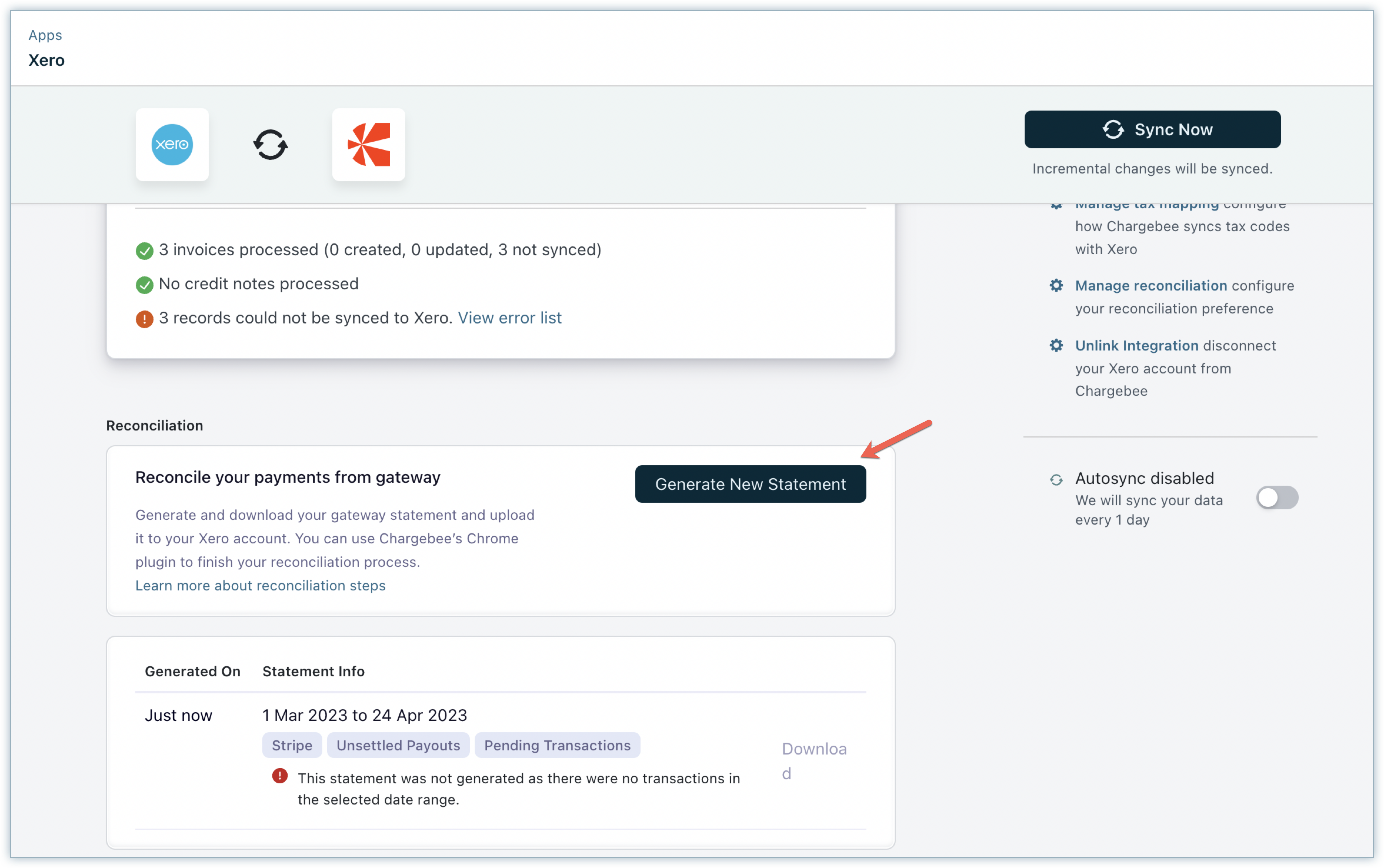

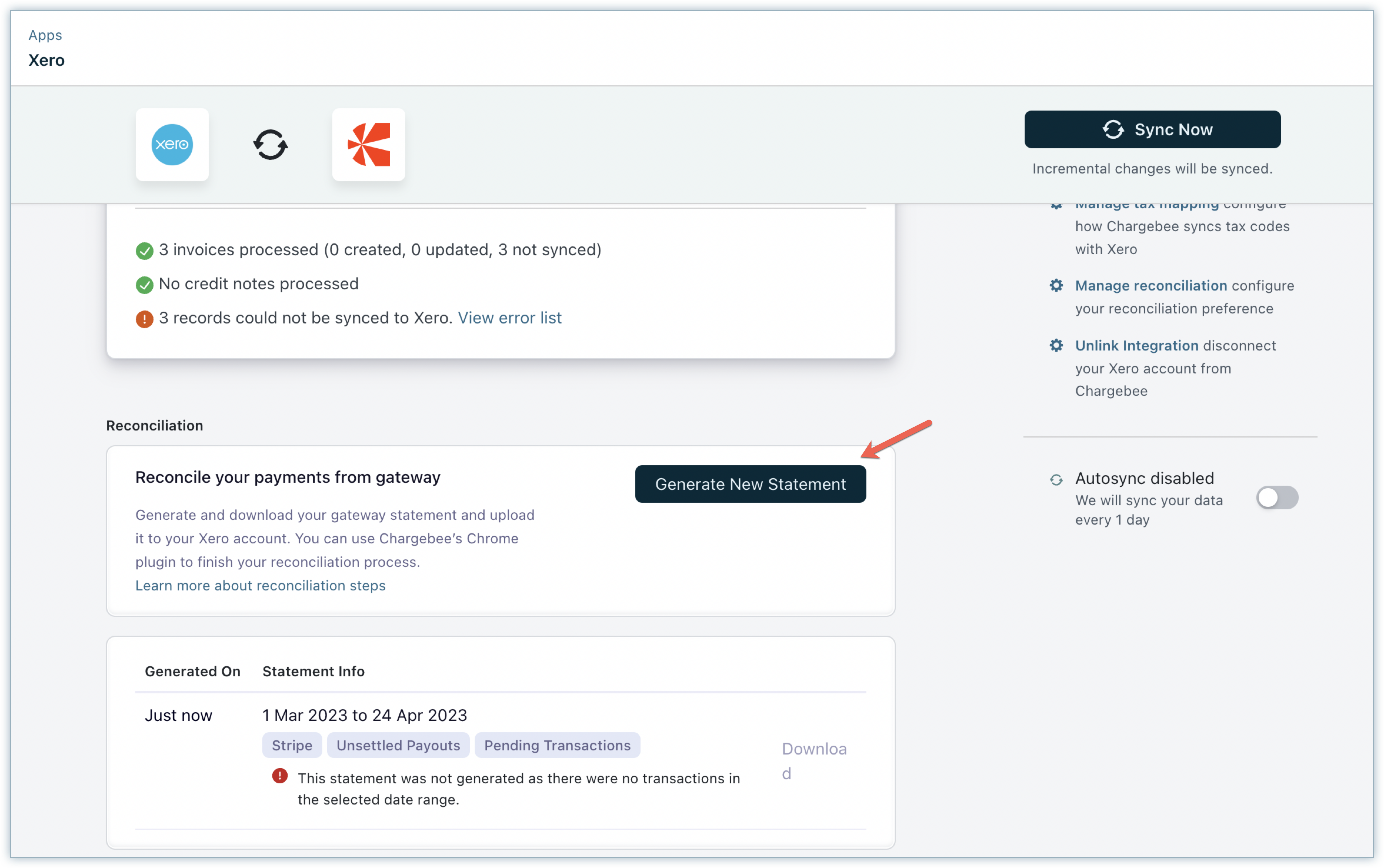

Reconciling Chargebee Invoices With Xero Chargebee Docs

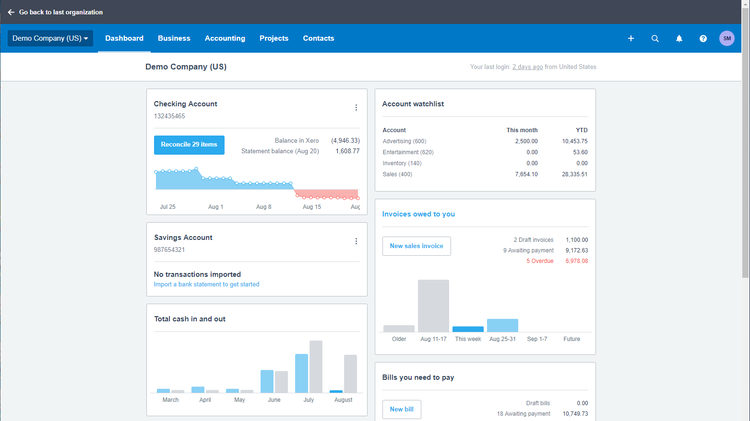

Small Business Accounting Software Xero My

Payroll End Of Financial Year In 7 Steps It S That Easy Xero Blog

Xero Integration Reach Reporting

![]()

Xero Review Pricing Features In 2022

8 Things Most People Forget With Their Xero Setup Bean Ninjas

Accept Payments Online Payment Processing Xero Us

How To Use Quickbooks And Xero For Your Month End Close Process

Xero Accounting Software Review 2022

Quickbooks Xero Sync Synder Auto Post Sales Fees And Inventory To Quickbooks Or Xero Shopify App Store

![]()

The Pros And Cons Of Xero S Time Tracking Feature

Expense Management For Xero Automated Accounting Meets Company Spend

What Is Xero And Why Should You Use Xero For Your Small Business